Lifetime Exemption 2025. Lifetime gift and estate tax exclusions. When that is exhausted future gifts above.

The estate tax is a tax on your right to transfer property at your death. The irs has increased the estate, lifetime gift, and gst tax exemption in response to inflation rates in 2025, offering an opportunity to preserve wealth for.

Navigating The 2025 Lifetime Exemption Amount Change Hunter Sargent, PLLC, The lifetime exemption is a set amount of cash or property that you can give away during your lifetime without having to pay federal gift taxes. Starting january 1, 2025, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person.

Amount Uncovering The 2025 Lifetime Exemption Amount What You Need To, Effective january 1, 2025, the lifetime exemption from the federal gift tax and estate tax will see a substantial increase. Also for 2025, the irs allows a person to.

Lifetime Capital Gains Exemption 2025 What Is It & How To Claim It, For 2025, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2025. Lifetime irs gift tax exemption.

Exemptions From Minimum Wage & Overtime Rules, The lifetime gift tax exemption is a federal tax law that allows an individual to give gifts of up to a certain amount without incurring gift taxes. The lifetime estate and gift tax exemption for 2025 deaths is $12,920,000.

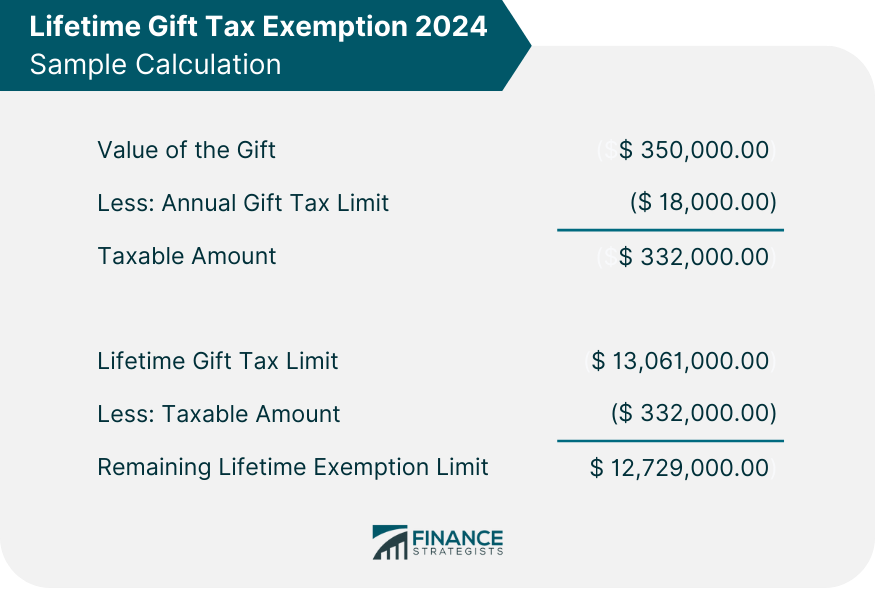

Gift Tax Limit 2025 Calculation, Filing, and How to Avoid Gift Tax, But the government does put a lifetime limit on how much you can give before it wants its share. Our guide shows how to leverage 2025's increased lifetime exemptions and gifting exclusions for substantial tax savings.

Lifetime Gifting Exemption (IHT) TT Wealth Estate Planning, The estate tax is a tax on your right to transfer property at your death. To address concerns expressed by a number of stakeholders, the final regulations clarify that people taking advantage of the increased bea by making gifts during the period.

Lifetime Gift Tax Exemption 2025 & 2025 Definition & Calculation, In other words, if you give each of your children $18,000 in 2025, the annual exclusion applies to each gift. With section 80c allowing deductions of up to rs.

Lifetime Gift Tax Exemption 2025 & 2025 Definition & Calculation, Estates of decedents who die during 2025 have a basic lifetime exclusion amount of $13.61 million, up from $12.92 million for estates of decedents who died in. The lifetime gift tax exemption is a federal tax law that allows an individual to give gifts of up to a certain amount without incurring gift taxes.

Understanding the Lifetime Capital Gains Exemption and its Benefits, For 2025, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2025. The irs has announced that for 2025, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person.

Lifetime Exemption 2025, When that is exhausted future gifts above. The irs has announced that for 2025, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person.

If you're married, your spouse is entitled to a separate $12.92 million exemption and can inherit your unused lifetime exemption by filing an estate tax return.

Estates of decedents who die during 2025 have a basic lifetime exclusion amount of $13.61 million, up from $12.92 million for estates of decedents who died in.